Investors seeking alternative investment options to hedge against market fluctuations should consider AUS & AGS. These assets have a long history of holding their value and serving as a store of wealth, and with the rebound phase of the liquidity cycle starting, gold and crypto prices are likely to rise, making AUS & AGS an attractive investment option. It's important to understand the benefits of investing in these assets, as well as the relationship between liquidity and their prices, and how to take advantage.

One of the key factors that investors should consider when making investment decisions is global liquidity. As Michael Howell, founder of CrossBorder Capital, has noted, the global liquidity index covering 90 central banks worldwide is beginning to rise after bottoming in October 2022. This rise in liquidity is due to factors such as central banks injecting money into the system, decreasing bond market volatility, a weaker US dollar, and lower oil prices. These factors are potentially very positive for asset prices, namely tokenised gold and silver.

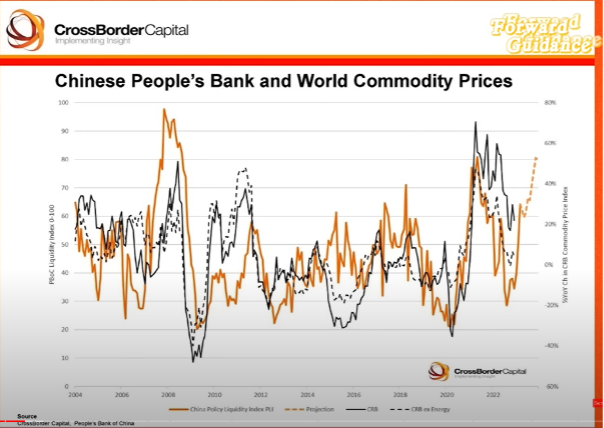

Central banks are injecting liquidity to prop up bank liquidity via the reverse repo market, ensuring the refinancing of global debt at higher interest rates. The People's Bank of China is also an important player in the world financial system, injecting liquidity to spur the economy, and commodity prices are likely to continue to rise.

While tokenised gold and silver have a long-standing appeal as a hedge against inflation and economic uncertainty, it's important to understand the benefits of these assets in this economic environment. Gold & Silver Standard has made it easier for investors to buy and sell gold and silver on the blockchain, offering a more accessible and convenient way to invest in these assets so they can take advantage of liquidity fluctuations.

The very fundamental reason all this liquidity is being injected is the now over $300 trillion of global debt that continually needs refinancing and refinancing now at much much higher interest rates. They simply cannot allow this to fail and hence need to prop up bank liquidity via the reverse repo market. As rates go up and more debt comes due to rollover, the more that needs to be put into the banking system to ensure it can be. That, quite simply, is more liquidity and it finds its way through the broader economy via financial markets.

One of the benefits of investing in AUS & AGS is their ability to protect against market fluctuations AND inflation. Unlike stocks and bonds, gold and silver tend to hold their value even during all times of economic turmoil. This makes them an attractive option for investors who are looking to diversify their portfolio and reduce their exposure to risk no matter the conditions.

Investors who are looking to profit from market fluctuations, especially in liquidity, should consider tokenised gold and silver. Gold and bitcoin are excellent monetary barometers that act as a hedge against monetary inflation, and their prices are likely to rise with the turning of the liquidity cycle. The current liquidity cycle is in the early stages of the rebound phase, with gold and bitcoin being in the "buy low" phase before calm and speculation phases.

Liquidity is crucial for the value of assets, and despite projections for recessions and hard landings, investing in risk assets is supported by the current global liquidity environment. Therefore, tokenised gold and silver are not only a historical store of value but also an investment option that is supported by the current liquidity cycle. This makes complete sense when you remind yourself that this new liquidity is just newly printed fiat currency. Such ‘money’ is in stark contrast to real money – money constrained in supply with resulting intrinsic value through rarity, fungibility, portability, and exchangeability. Debate may rage over bitcoin meeting these but 5000 years of history has established gold as the very definition of it.

Stay up to date with our gold and

silver news and pricing.