At Gold & Silver Standard, our firsthand experience in the bullion industry provides us with a unique vantage point. Recently, we've observed a discernible shift in consumer preference towards silver, a trend that's gaining traction globally, with India at the forefront.

India's role as a major consumer of silver is significant, representing approximately one-eighth of global demand. The latest data is particularly revealing, with India importing a record-breaking 1700 tonnes of silver in a single month of 2023. This surge is predominantly in bar form, diverging from the grain format typically favoured by manufacturers.

This pattern mirrors the notable silver rally of 2011, where prices escalated from $22 to $49 in a mere six months, alongside a substantial contraction in the gold-to-silver ratio (GSR) from 70 to 31. Presently, with the GSR lingering at 83, a similar trajectory could see dramatic increases in silver prices.

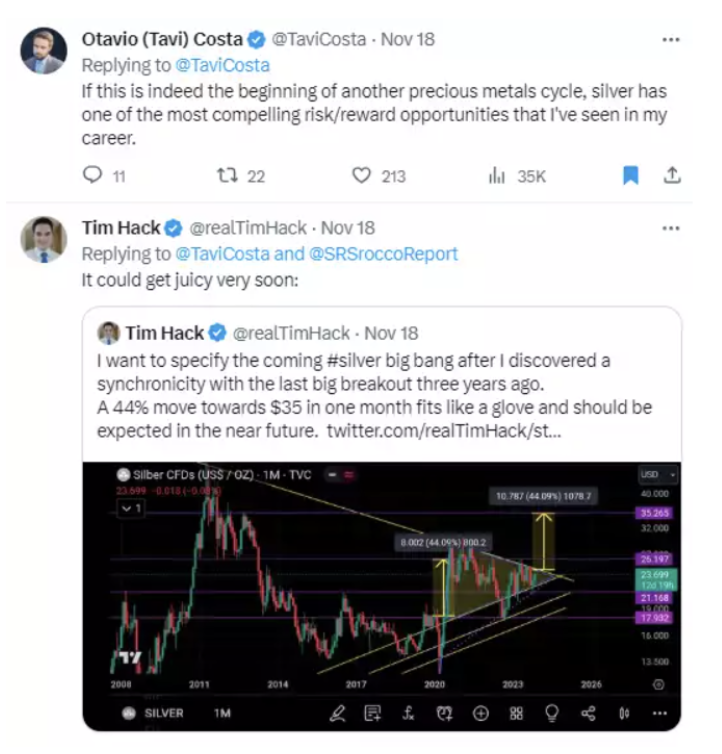

Silver's market behaviour is characterised by its tendency to trail behind gold, yet it often eclipses gold in performance during a rally. This inherent volatility in silver can present lucrative opportunities for astute investors when timed correctly – which some wise investors are speculating with below:

Turning our focus to our Gold Standard (AUS) and Silver Standard (AGS) tokens, these innovative assets offer a contemporary approach to investing in precious metals. Merging the timeless value of silver with the efficiency and security of blockchain technology, these tokens represent a forward-thinking investment strategy. As silver's potential rise gains momentum, our AUS and AGS tokens stand as a testament to our commitment to offering diverse and adaptive investment vehicles in the ever-evolving financial landscape.

AUS & AGS are available at reputable platforms such as Ainslie Crypto, CoinSpot, Metex, MRHB DeFi, and Bamboo. Embrace the future of stable and secure digital currencies and stay ahead in this ever-changing financial world.

Stay up to date with our gold and

silver news and pricing.