Today, we're taking a close look at the World Gold Council's recent report, revealing a strong, ongoing demand for gold. It's more than just interesting market analysis; it's the kind of insight that directly bolsters the value of our Gold Standard (AUS) token. As national reserves grow and central banks stock up on gold, our AUS token stands as your opportunity to tap into this wealth-preserving power, blending the reliability of gold with the efficiency of blockchain technology.

So let’s have a look at the key findings from the report.

In summary, jewellery demand has moderated somewhat in light of soaring gold prices, and investment interest presents a mixed picture – robust year-on-year yet tempered by ETF pullbacks. Overall, gold demand in Q3, excluding over-the-counter trades, stood firm at 8% above the five-year average, despite a 6% year-on-year dip, totalling 1,147 tonnes.

Central Banks' Appetite for Gold

Central banks maintained a voracious appetite for gold in Q3, culminating in a year-to-date acquisition of 800 tonnes – a 14% hike from last year's equivalent period and a new record. The People's Bank of China (PBoC) notably reclaimed its position as the top buyer, amassing an additional 78 tonnes during the quarter, bringing its yearly total to a hefty 181 tonnes.

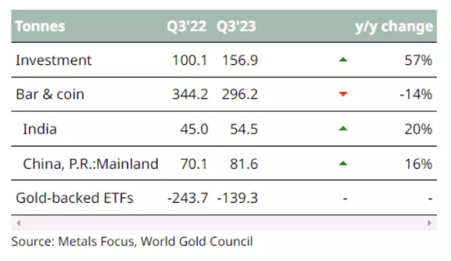

Investment

The investment sector in Q3 was characterised by a significant rebound from the previous year's lows yet fell short when measured against long-term averages. Gold ETFs saw their sixth quarter of consecutive outflows, shedding 139 tonnes, while bar and coin investment dipped by 14% year-on-year to 296 tonnes, primarily due to a slowdown in Europe. Year-to-date, total investment demand is down 21%, primarily driven by sustained ETF outflows concentrated in Western markets.

Jewellery: A Slight Ebb

Jewellery consumption experienced a modest year-on-year decrease of 2% in Q3, influenced by high gold prices and economic uncertainty, especially in price-sensitive Asian and Middle Eastern markets. Nonetheless, year-to-date figures are holding steady, paralleling the same period in the previous year.

Technological Use

The technology sector saw a slight recovery from a weaker first half, yet demand remained subdued compared to previous years, with a 3% year-on-year decline in Q3. The electronics sector, which commands the majority of technology demand, fell by 4% year-on-year.

Supply: A New Peak in Production

Q3 heralded a 6% year-on-year increase in total gold supply, with a record-breaking 971 tonnes from mine production and a rise in recycled gold to 289 tonnes. The upswing in mine production and recycling has contributed to a total supply of 3,692 tonnes year-to-date.

Navigating the Future with Gold-Backed Tokens

Our ERC20 tokens, Gold Standard (AUS) and Silver Standard (AGS) offer a seamless blend of traditional investment security and modern-day digital convenience. They are not just tokens; they are your bridge to the enduring value of gold and silver, fully verified quarterly by PKF and secured in a world-class facility, ensuring your peace of mind.

As we continue to witness global shifts in gold demand and supply, the Gold & Silver Standard stands as your easy, secure and robust precious metals investment in the crypto industry.

Stay up to date with our gold and

silver news and pricing.